Take our fundability quiz

Non Bank Commercial Property Loans

We help first time, underserved, ghosted, or recently rejected real estate investors & landlords get fast, flexible funding for investment properties.

- Buy

- Rehab/Stabilize

- Cash Out Refi

- Bridge to Permanent

What We Fund

Cash-flowing or value-add deals that need fast funding.

Up to $3M

Up to $3M

This is our sweet spot !

💼Up to $50M

if the numbers make sense

How We Fund

We work with private lenders, debt funds, and select non-bank partners to offer funding solutions that move at the speed of your deal. We do our best to help you leverage your holdings and not decrease your cash position.

🏦

Bridge Loans

Fast, flexible financing for purchases, rehabs, refis, and time-sensitive deals (21 days on average)

💼

SBA 7(a) EXPRESS Loans

Long-term financing with low down payments for qualified owner-users and some investment properties (funding in 60 days or less)

🏦

Commercial DSCR Loans

Cash flow-based loans for rental properties with minimal income verification

🏦

Hard Money & Private Lending

Short-term options for value-add and transitional properties (residential under 4 units)

🏢

Small Balance Commercial Loans

For deals under $3M that traditional banks won’t touch

🌍

Foreign National & Non-Recourse Options

Case-by-case solutions depending on the property, structure, and exit

🏦

Portfolio Loans

Ideal for landlords and largely self-funded residential portfolios.

🏢

Transactional Funds

Escrow protected funds for wholesaler double closing or seller carry HUD statements

🌍

Fix and Flip*

Mixed portfolio investors with 2+ successful fix and flips required in the past 3 years.

Every deal gets matched based on risk, asset type, and the best path to close—not a one-size-fits-all lender list.

Who Is This For

unbanked & underserved cre investors

We work with:

- Commercial Investors who write off everything, but themselves!

- Multifamily Investors & Landlords who need fast, short, or long-term funding

- Investors who know & understand their numbers

- Investors who need funding to buy, refinance, and/or rehab a property

Why Us

We speak CRE fluently!

We’re investor-friendly because we invest in commercial real estate, too! We have the ability to personally connect you with Deal Finders, Insurance Agents, Title Companies, KP’s (debt sponsors), GP’s (General Partners), and Asset Managers to help complete your commercial real estate deal team.

Property Types We Fund

Multifamily

Luxury, Market Rate, Affordable, Senior & Student Housing

Healthcare

Owner-Occupied, Commercial Medical Office, Assisted Living, Nursing Homes

Retail

Single-Tenant, Multi-Tenant, Owner-Occupied Retail; Credit Tenant Leases

Self-Storage

Self-Storage: Refinance or Shovel Ready New Construction

Others

Warehouse, Industrial, Portfolio Loans for Single & Multifamily. Hospitality, Automotive Parks, Fix & Flip*

Office

Single Tenant, Multi-Tenant and Owner-Occupied

How We Work

3 Steps. No Guesswork.

Book a Strategy Call for YOUR next steps!

We match your deal with lenders via data points

Who’s Your Broker?

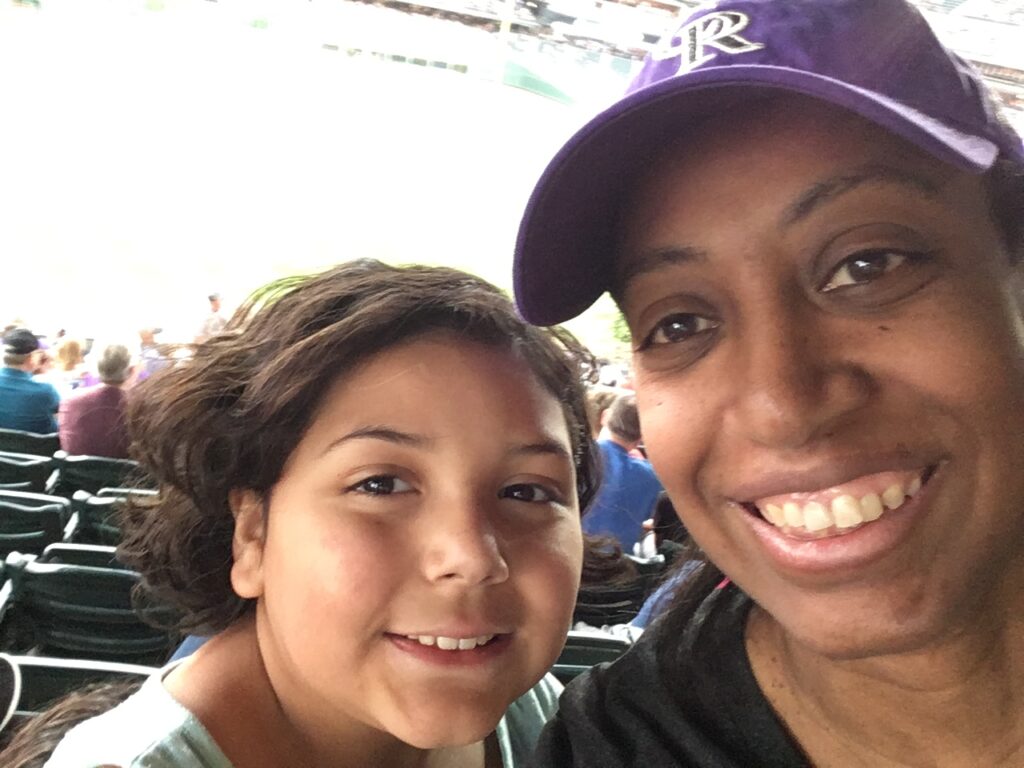

Fund Founder. Endless Do-Gooder.

Shoni lives where real estate meets real impact. She uses a bit of AI & tech and a hella lot of life experience to help people get funded, grow faster, and live better—focusing on small balance deals that make a big difference.

Shonika Proctor is a former tech geek turned Commercial Real Estate junkie and your soon to be favorite finance funny girl. She grew up in a skilled trades family that loved building — motocross bikes, race cars, and their own way through hard work, kindness, and resourcefulness.

Based in Colorado | Nationwide Funding

CRE drama, decoded.

Loan & Order: Live Better CRE Unit

Talk to Us!

We are ‘people’ people. Our goal is to make the hard, complex, or sometimes stressful things easy’er for you. And ultimately help you live better! Don’t be scurred to reach out with your CRE question(s). We got you!